what is fit tax on paycheck

It can let you adjust your tax withheld up front so you receive a bigger paycheck and smaller refund at tax time. With this information you can prepare for tax season.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37.

. Wage bracket method and percentage method. 17 hours agoAn estimated 725 million households -- or 40 of total households -- will pay no federal income taxes for tax year 2022 according to an analysis from the Tax Policy Center. Your net income gets calculated.

Thats the deal only for federal income. The federal income tax rates remain. That 14 is your effective tax rate.

35 for incomes over 207350 for individuals and 414700 for married couples filing jointly 32 for incomes over 163300 for individuals and 326600 for married couples filing jointly 24. Fit stands for Federal Income Tax Withheld. What percentage is fit tax.

Income taxes are taxes on income both earned. The FIT deduction on your paycheck represents the federal tax withholding from your gross income. Federal income tax is a tax levied by the Internal Revenue Service on the annual earnings of individuals corporations trusts and other.

The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket. 2 days agoThe 2023 standard deduction for couples married filing jointly is 27700 up 1800 from 25900 in tax year 2022. The Number Of Those Who Dont Pay Federal Income Tax Drops To Pre-Pandemic Levels.

Federal income tax rates range from 10 up to a top marginal rate of 37. So when you file your return youll get. 10 12 22 24 32 35 and 37.

What is the fit tax rate for 2020. It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. Fit is the amount required by law for employers to withhold from wages to pay taxes.

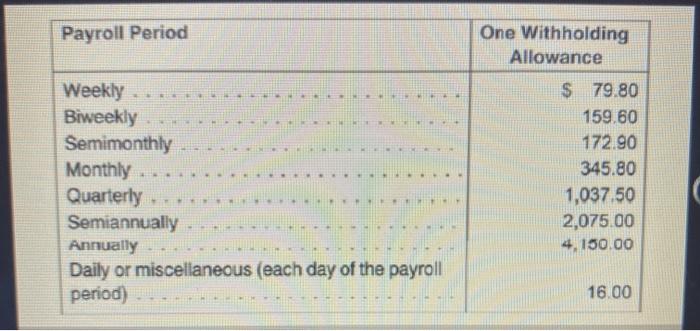

For employees withholding is the amount of federal income tax withheld from your paycheck. Employers withhold FIT using either a percentage method bracket method or alternative method. Oct 27 2022 1013am EDT.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. FICA taxes consist of Social Security and Medicare taxes. Federal Paycheck Quick Facts.

FIT taxes are what most people call federal income taxes The Internal Revenue Service IRS provides the following definition. For those filing head of household the standard deduction will. There are seven federal income tax rates in 2022.

The employee is responsible for. Median household income in 2020 was 67340. Federal income tax might be abbreviated as Fed Tax FT or FWT.

Security The Tax Withholding Estimator doesnt ask for. However they dont include all taxes related to payroll. The amount of income tax your employer withholds from your regular pay.

FICA taxes are commonly called the payroll tax. Your federal withholding is the amount that youve already paid the federal government. The percentage method is based on the graduated federal tax rates 0.

What Is Federal Income Tax. Your bracket depends on your taxable income and filing status. If youre one of the lucky few to.

3 Tax Credits You Need To Know About Now. There are seven federal tax brackets for the 2021 tax year. There are two federal income tax withholding methods for use in 2021.

How To Calculate Payroll Taxes Wrapbook

How To Calculate Federal Income Tax

Solved Larren Buffett Is Concerned After Receiving Her Chegg Com

Federal Income Tax Fit Payroll Tax Calculation Youtube

Explaining Paychecks To Your Employees

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

New Tax Law Take Home Pay Calculator For 75 000 Salary

Who Owns Your Paycheck Life And My Finances

What Is Meant By Payroll Tax Are Employers Actually Taxed On The Salaries They Pay Employees What Does The Term Payroll Tax Means Quora

Paycheck Calculator Take Home Pay Calculator

What Is Payroll Accounting Definition And Examples Bookstime

Take Home Paycheck Calculator Hourly Salary After Taxes

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How To Calculate Payroll Taxes Futa Sui And More Surepayroll